International Inheritance Consulting

International Inheritance/Estate Tax Consulting

We provide inheritance tax consulting services such as the following cases.

■ 1. If there are foreign estates

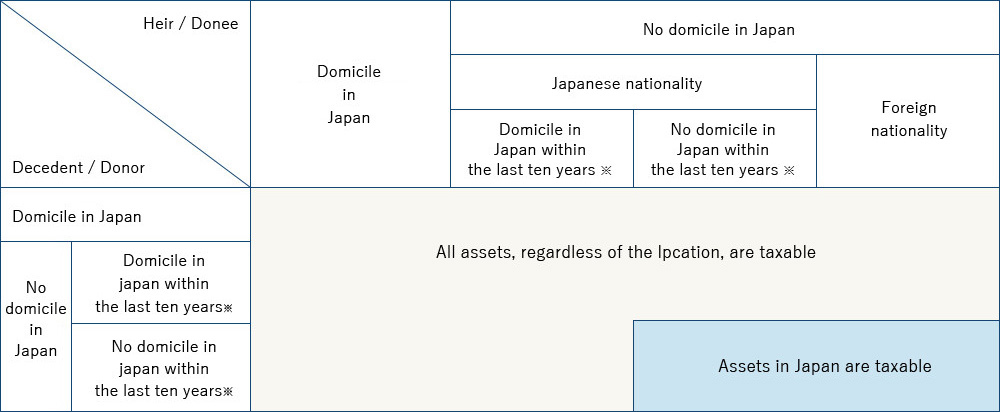

This case is that a decedent and heirs have Japanese nationality and a domicile in Japan and the decedent has foreign estates. Recently, Japanese investors have been investing abroad. Even if the inherited assets are located abroad, they are subject to Japanese inheritance tax in this case. If the heir is subject to inheritance tax in other country, the inheritance tax amount of the country is deducted from Japanese inheritance tax.

Moreover, if there is foreign real estate such as land or the buildings, it is required to estimate the property’s local fair market value since evaluation method in Japan is not applicable. We have prepared a lot of inheritance tax returns, and we have knowledge about the case that there are foreign estates.

■ 2. If heirs live abroad

If heirs do not have Japanese nationality and if they and a decedent have lived abroad, estate in Japan is subject to inheritance tax but foreign estate is not taxable.

In any case, if heirs inherit assets located in Japan, they are liable to pay inheritance tax in Japan. We have prepared lots of inheritance tax returns in this case.

※ Inheritance tax is applied for assets inherited beyond April 1st , 2017.

■ 3. If an heir who does not have Japanese nationality is married to Japanese

In case that a decedent and heirs have foreign nationalities and an heir has lived in Japan, there might be inheritance tax to pay in Japan regardless of nationality of the decedent and heirs. (e.g. international marriage and domicile in Japan)

In this case, please pay special attention to the problem of dual citizenship and laws of each country.

The most common case mentioned above is “2. If heirs live abroad”.

If heirs live abroad, they do not have registered personal seal to be placed on Agreement on Division of Estates in Japan. Therefore, for example, you should bring Agreement on Division of Estates into embassy of Japan in the USA and obtain Signature Certificate in the United States. The inheritance tax return is due ten months after the date of death, so please proceed the procedures as soon as possible.

Points to note

We are a certified tax accountant office, and the scope of our service is basically related to TAX. If it is almost certain that the total amount of assets located in Japan and abroad exceeds basic exemption of inheritance tax, please contact us.

* Basic exemption of inheritance tax = JPY30Million + Number of legal heir × JPY6Million

If amount of estates does not exceed basic exemption mentioned above, the filing of tax return is not required.

International inheritance consulting service fee

■ 1. Inheritance Tax Return

We provide the service at a price of “Inheritance tax Plan”.

*Additional fees might be charged for the evaluation of overseas assets depending on the situation.

■ 2. Tax planning

Our fee for tax planning depends on the value of assets.

Estimation and a first consultation are free of charge, so please feel free to contact us.

お約束いたします

チェスターの相続税申告は、税金をただ計算するだけではありません。

1円でも相続税を低く、そして税務署に指摘を受けないように、

また円滑な相続手続きを親身にサポートします。